Credit and debit memos Zuora

Content

INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. GuideInvoicing Guide Know anything and everything about invoices and invoicing process. Real-time Notification Get notified whenever estimates and invoices are opened or payouts proceeded. Client Forget the hassle of adding clients every time. Enter the check number, which is used by supplier to pay the refund amount.

Using the Service Quantity, Unit of Measure and Price fields, enter the corrected information . Specify Description of the memo detail you are creating. For example, a memo detail may be a reference to a line in the billing order you are adjusting with this memo. Skip the Document # field as the number will be assigned automatically. If the memo has been distributed, but an amount change requires that it be re-calculated, use this button.

Debit Memos in Incremental Billings

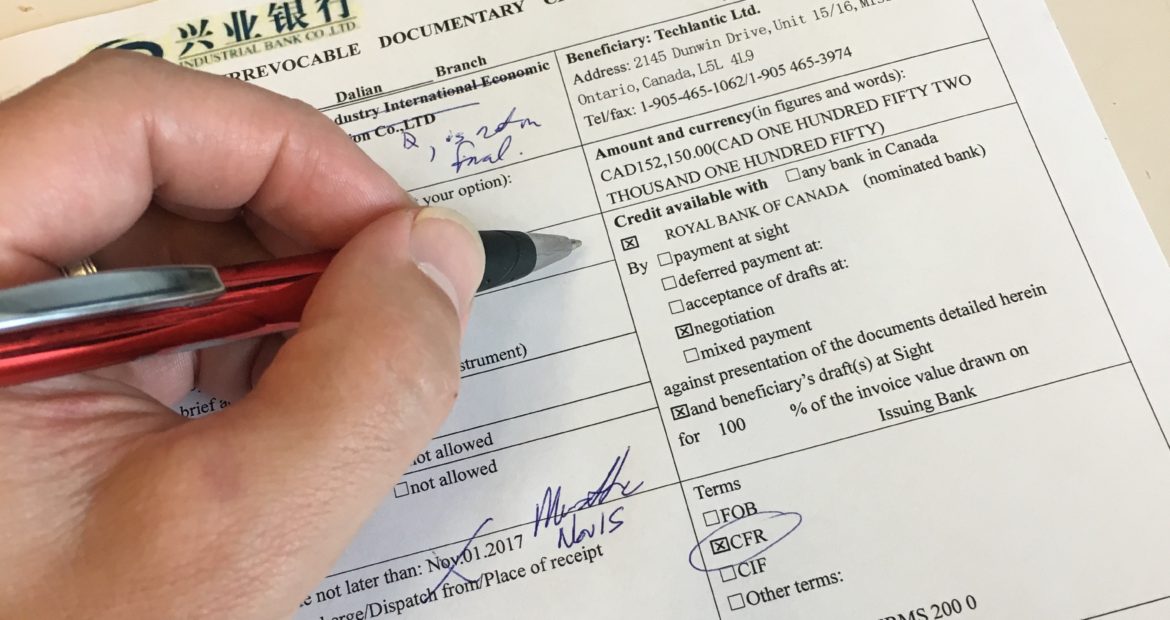

A debit memo can be used to reverse an overcharged customer’s payment. This enables the accounting division to resolve it by returning the memo to the client. In banking, fees are deducted from an account automatically, and the debit memo is recorded on the account’s bank statement. In many cases, debit memos get issued due to damaged or incorrect goods or a purchase cancellation, for example. This date will be used for aging of the credit memo, but not for the General Ledger distribution, which will use the date of record entered when the batch is posted.

Reason codes are used to explain why an adjustment is being made to a customer’s account. Panel UI, such documents are actually assigned to the reseller transactions that correspond to order items in a customer’s order. Selecting it implies that sales taxes are applicable to the credit memo. If the credit memo is not taxable, leave the Tax Category field blank. To add a new credit or debit memo to the batch, click the block toolbar’s button; and to remove one from the batch, click . Select the debit memo to include on this invoice by using the purchase order number, RMA number, project number or order number.

How Does a Debit Memo Work?

Insufficient funds, overdraft fees, bank service charges, and check printing costs are a few reasons a bank might withdraw money from an account. A redit memo has preceding document called a credit memo request while a debit memo is also debit memo accounts payable preceded by a debit a memo request to facilitate its usage. A debit note acts as a buyer’s formal request for a credit note from the seller. The document serves as evidence to support a purchase return in the accounting books of a buyer.

Adjustments are more properly made by the purchaser as an internal correction (for data entry errors, etc.) and are not necessarily accompanied by formal documentation. A memo will be a separate line item on the vendor’s account and on reports. An adjustment will only affect the General Ledger and not the vendor balance.

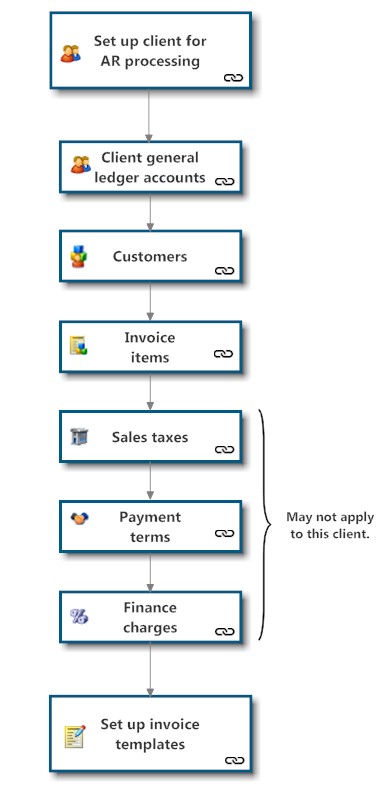

Practice CS: Entering Accounts Receivable Adjustments: Credit Memos, Debit Memos, and Write-Offs

You issue a debit note to return the payment offset to the customer. The customer would either receive or his applicable state government. A debit note is also known as a debit memorandum, or a debit memo for short. All of these three terms have the same meaning and are used interchangeably in practice. A debit memo can also help when the value of previously invoiced items has increased after the date of invoice issue due to changes in price, terms of an agreement, etc. Buyer issues a debit memo and debits Accounts Payable to request a reduction in an amount due to a seller, for example when returning faulty goods.

What is debit memo in accounting?

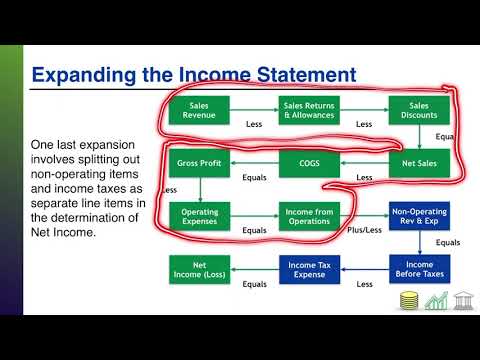

Debit memos, also called debit notes, are corrections to invoices. If you accidentally submit an invoice that's too low, you can send a debit memo to correct it and increase the invoice after it's sent. The customer can then use the memo to adjust their books, as well.